When it comes to complying with regulations, a proprietorship firm has fewer requirements compared to other business structures like companies and Limited Liability Partnerships (LLPs). However, there are still several important compliances every proprietor needs to be aware of and follow. Here’s a breakdown by category:

Tax Compliance:

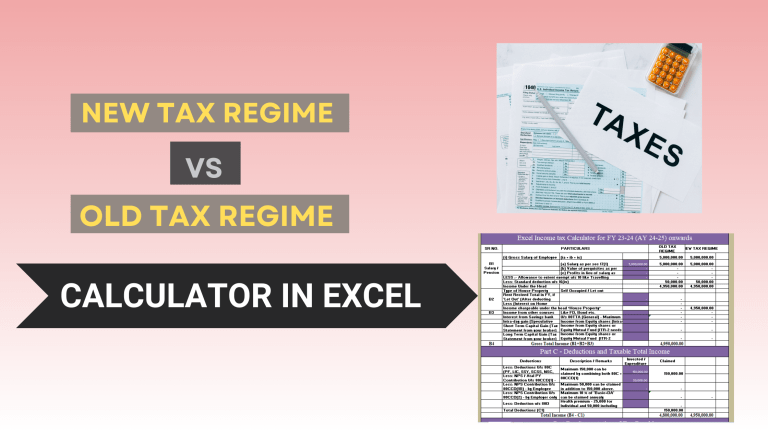

- Income Tax Return (ITR): This is the most crucial compliance. Every proprietor needs to file an ITR annually (unless exempted), declaring their business income along with personal income. The specific form used (ITR-3 or ITR-4) might depend on the nature and turnover of the business.

- Goods and Services Tax (GST): If your annual turnover exceeds ₹20 lakhs, GST registration is mandatory. This involves filing regular GST returns (GSTR-3B, etc.) and adhering to invoicing and accounting requirements.

- Tax Deducted at Source (TDS): If you make certain payments exceeding specific thresholds (e.g., rent, professional fees), you need to deduct TDS at source and deposit it with the government.

Financial and Accounting Compliance:

- Maintain Books of Accounts: If your annual turnover exceeds ₹25 lakhs or your income from the business exceeds ₹2.5 lakhs in any of the preceding 3 years, maintaining proper books of accounts is mandatory.

- Audit Requirements: If your annual turnover exceeds ₹1 crore, a tax audit is mandatory.

Other Regulatory Compliance:

- Shop & Establishment Act Registration: Depending on your location and type of business, registration under the Shop & Establishment Act might be necessary.

- Environmental Regulations: Certain businesses might need to comply with specific environmental regulations depending on their operations.

- Labor Laws: If you employ workers, compliance with labor laws like minimum wage, working hours, etc., is crucial.

Additional Points:

- Record Keeping: Always maintain proper records of all financial transactions, receipts, and business documents for potential audits or inquiries.

- Professional Help: Consulting with Company Mitra can help ensure you adhere to all relevant compliances and avoid penalties.

- Stay Updated: Regulatory requirements and laws can change over time. Stay informed about any new regulations or updates that might impact your business.