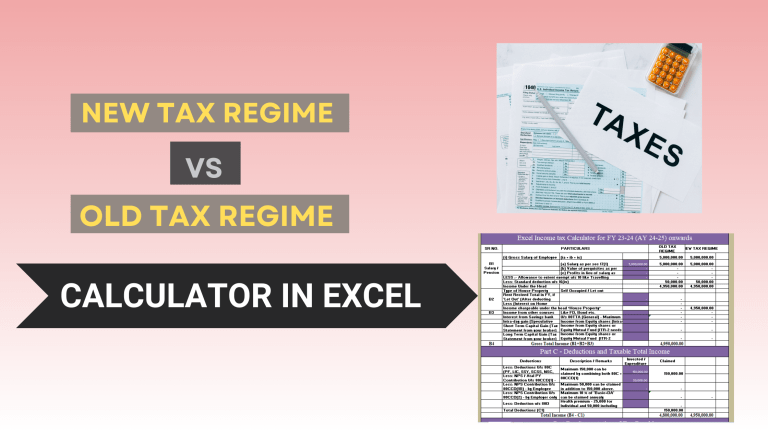

Free Excel Calculator for Old vs. New Tax Regime tax comparison!

Tax season can be stressful, but what if you could simplify the process and potentially save money? Introducing our Free Old vs. New Tax Regime Calculator in Excel! This handy tool helps you understand the key differences between the two regimes and determine which one benefits you the most.

Confused About Tax Regimes?

India offers two options for filing income tax returns: the old regime and the new regime. Each has its own set of rules and benefits. Here’s a quick breakdown:

- Old Tax Regime: This traditional regime allows you to claim various deductions under sections like 80C, 80D, and HRA. These deductions can significantly reduce your taxable income, potentially leading to a lower tax burden. However, the calculation process can be complex due to the numerous deductions involved.

- New Tax Regime: Introduced in 2020, this regime boasts lower tax rates compared to the old regime, especially for lower income slabs. Filing taxes under the new regime is generally faster and easier as it offers minimal deductions (mainly a standard deduction). However, you lose the flexibility to claim many deductions that could potentially save you tax.

Why Use Our Excel Calculator?

Our user-friendly Excel calculator takes the guesswork out of choosing the right tax regime. Here’s what it offers:

- Easy Input: Simply enter your income and relevant details.

- Automatic Calculations: The calculator performs complex calculations behind the scenes, showing your tax liability under both regimes.

- Clear Comparison: See the difference in tax amount between the two regimes, helping you make an informed decision.

- Save Time & Money: This free tool helps you potentially save money by choosing the most tax-efficient regime for your situation.

Download Your Free Calculator Today!

Ready to simplify your tax filing and potentially save money? Download our Free Old vs. New Tax Regime Calculator in Excel by clicking the link above . Remember, this blog post provides a general overview, and consulting a tax advisor is always recommended for personalized advice based on your specific financial situation.

Happy Tax Planning!