Your One-Stop Guide to Compliances for Partnership Firms: Building a Smooth and Successful Collaboration

Running a partnership firm requires not just strong teamwork but also a solid understanding of essential legal and regulatory requirements. Here’s a comprehensive breakdown of key compliance areas for your partnership firm to navigate:

1. Registration and Partnership Deed:

- Mandatory registration: Most states in India require partnership firms to register under the Indian Partnership Act, 1932.

- Partnership Deed: This crucial document outlines the partnership structure, capital contributions, profit-sharing ratio, rights & responsibilities of partners, and dispute resolution mechanisms.

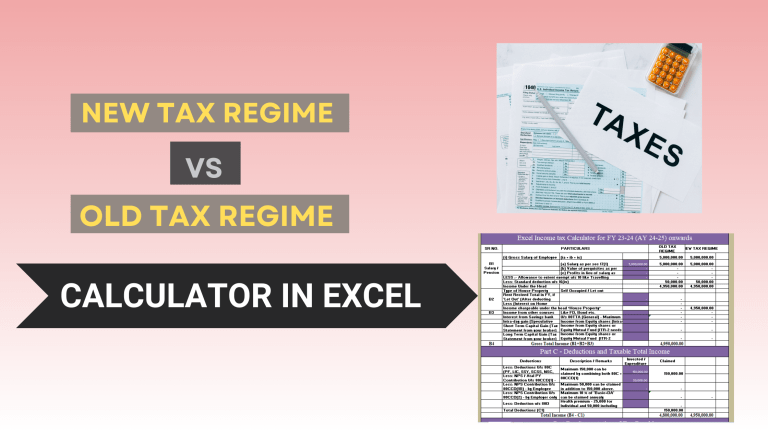

2. Income Tax Compliance:

- Partnership firm filing: While the firm itself isn’t taxed, partners are taxed individually on their share of profits. The firm needs to file an annual return of income (ITR-5) declaring total income and partners’ shares.

- Partners’ individual filing: Each partner files their individual ITR (e.g., ITR-2) declaring their share of firm income along with other income sources.

3. Goods and Services Tax (GST):

- Registration: If annual turnover exceeds Rs. 20 lakhs, GST registration is mandatory. Partnerships also have the option to register voluntarily even below the threshold.

- GST Returns: Regular filing of GST returns (GSTR-1, GSTR-3B, etc.) is required, reporting sales, purchases, tax liability, and claiming input tax credits.

4. Shop & Establishment Act Registration:

- Applicability: Registration might be mandatory if your firm operates a shop, office, restaurant, or similar establishment within a state where the Shop & Establishment Act is in force.

- Compliance: Maintain employee register, display notice board detailing licenses, working hours, wages, etc., and comply with minimum wage and working conditions regulations.

5. Environmental Regulations:

- Applicable based on activities: Depending on your business activities and potential environmental impact, specific environmental clearances, waste management practices, and pollution control measures might be required.

- Compliance: Consult your local environmental agency to understand applicable regulations and ensure responsible environmental practices.

6. Labor Laws:

- Minimum wages, working hours, leaves, social security: If you employ one or more individuals, comply with mandatory labor laws regarding minimum wages, maximum working hours, leaves, and social security contributions (PF, ESI) for your employees.

- Safe working conditions: Provide a safe and healthy work environment as per safety regulations.

7. Other Statutory Compliances:

- Professional tax: Partners might be liable for professional tax depending on their individual income and state regulations.

- Contractual obligations: Comply with any specific legal agreements or contracts entered into by the partnership.